Climate shocks and debt service suspension in low and middle-income countries: Rethinking the climate-debt nexus through facts an numbers

June 14, 2023

Agence Francaise de Developpement provides funding to the Center for Global Development

The principle of debt service suspension in the aftermath of climate shocks has been placed at the top of the international financial architecture agenda. In a context of heavy financing constraints in developing countries, this type of instrument is appealing. During COP27, UK Export Finance (UKEF) has announced that it will offer Climate Resilient Debt Clauses (CRDC) in its direct sovereign lending. The Summit for a New Global Financial Pact that will take place in Paris in June 2023 could also lead to the development of innovative mechanisms, including debt-linked instruments, to finance losses and damages as well as adaption to climate change. However, a prior study of the efficiency and feasibility of such measures should be a prerequisite in order to implement an operational framework. Quantifying both the financial impact of climate shocks and debt service figures shows that : i) multi-year debt service suspensions could be required to provide sufficient relief in most cases; ii) a joint effort from all external creditors, including multilateral institutions and bondholders, could be needed to ensure efficiency ; iii) tailored mechanisms and/or additional financing instruments could be necessary, especially for the most vulnerable countries.

A dangerous nexus: persistent sovereign debt vulnerabilities and intensifying climate catastrophes

Debt service suspension in the aftermath of climate shocks is not a new principle. It has been implemented in “hurricane clauses” introduced in bond issuance from Grenada and Barbados. The rationale for scaling-up this type of instrument beyond SIDS (Small Island Developing States) is obvious given the growing climate-debt nexus, which states that climate shocks induce a shock on debt sustainability (due to the impact on real economy and financing needs) while fiscal constraints impede the capacity of countries to invest in adaptation measures. Sovereign debt vulnerabilities in low- and middle-income countries (LMICs) are persistent and have even been deteriorating on average in the recent period, as demonstrated by the increase in low-income countries at high risk of debt distress or debt crises in middle-income countries (Lebanon, Sri Lanka, Pakistan, Tunisia). Meanwhile, high exposure to climate change led to severe climate-related events in a number of LMICs – for instance, Pakistan in 2022 faced an exceptional heatwave followed by catastrophic floods months later with losses and damages amounting to 10% of GDP. The impact of climate-related catastrophes is to increase exponentially as the probability of occurrence and the severity of catastrophes will rise with climate change. Debt service suspension might therefore be seen as providing a global solution to a global public good, similarly to the G20 DSSI implemented in the aftermath of the pandemic. However, the efficiency of such a mechanism should be evaluated in order to make it work.

The impact of climate-related events in LMICs is high while debt service suspension can only provide limited relief without strong international coordination

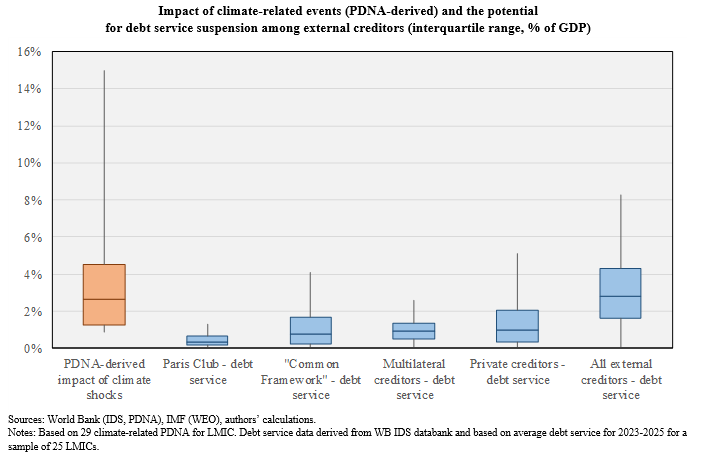

The impact of natural disasters on debt sustainability in LMICs is a topic of research in the economic literature, even though no quantified effect has been unequivocally identified yet. There are multiple and simultaneous channels of contagion, all pointing out to an increase in financing needs that can lead to liquidity crises and ultimately to debt distress. The impact is unevenly distributed and, in a small number of cases, is elevated. An estimation of this impact can be derived from the impact on the economy, as measured by losses and damages computed by the World Bank in its Post-Disaster Needs Assessments (PDNA). A sample of 29 climate-related (floods, typhoons, landslides, droughts) in non-SIDS LMICs[1] show that the impact is severe: it ranges from 0.8% of GDP and can reach 15% of GDP, with a median of 2.6% of GDP. The median for the top two quartiles is 4.5% of GDP and the mean for the upper quartile is 9% of GDP.

Compared to this estimated impact of climate-related events, external debt service suspension[2] can provide only limited relief. A one-year debt service suspension from Paris Club creditors would provide on average a relief equivalent to 0.4% of GDP (similar to what Paris Club provided on average during the DSSI exercise). The participation of G20 non-Paris Club official creditors (a setting similar to the “Common Framework for Debt Treatment”) would add another 0.2% on average, amounting to 0.6% even though in can reach 4% of GDP for some countries highly indebted to specific bilateral creditors. Multilateral creditors could in theory provide a one-year relief equivalent to 0.5%-2,5% of GDP and external private creditors a relief comprised between 0% and 5% of GDP. As a result, no single group of creditor can provide on average a one-year debt relief that can match the order of magnitude of climate-related shocks. Efficiency in this matter probably requires a combination of multi-year suspension and coordination among creditors – similar to the Paris Club comparability of treatment principle. Combined efforts of all external creditors could indeed provide a debt service relief that could match the financing needs of LMICs impacted by climate-related events. However, it requires a level of coordination among external creditors that has never been achieved before – delays in “Common Framework” debt treatments are a good example of how lengthy such processes can be. The French Development Agency has designed a countercyclical loan with up to 5 years debt service suspension in case of macroeconomic shocks in the late 2000s., but its impact has been weak on its own Additionally, it also requires a participation of multilateral lenders in the form or debt service suspension, something that has rarely been granted in the recent period. This is all the more true that the vast majority of LICs are mainly indebted to multilateral lenders, questioning the efficiency of a mechanism that would developed by bilateral creditors only.

Differentiated impacts: the case for tailored financial instruments, specifically for SIDS

For most countries, a multi-year debt service suspension including all external creditors might provide significant liquidity relief and help maintain debt trajectories on a sustainable path. The efficiency of such a mechanism however relies on preexisting risks and vulnerabilities, namely debt structure, macroeconomic conditions and exposure to climate change. Given its nature, it works best in liquidity-constrained and BoP vulnerable LMICs, where there is little ex ante fiscal space to cope with additional exogenous shocks. The acceptability of such measures among all external creditors also depends on the structure and size of the economy. In India, a generalized debt service suspension from all external creditors would provide a relief equivalent to 0.8% of GDP but amounting to $23 billion; while in El Salvador it would amount to $2.3 billion but represent 7% of GDP (an impact that is therefore a hundredfold). Finally, it is necessary to develop additional instruments for countries where climate shocks impacts are significantly higher than debt service suspension. These differences among LMICs and their level of exposure to climate change show that there is no single cure to the climate-debt nexus. The measure and definition of multidimensional (macroeconomic and climate change) vulnerabilities would be essential to define countries where this type of instruments work best.

The case of Small Islands Developing States (SIDS) is very specific given the strength of the climate-debt nexus. Based on a similar methodology, PDNAs for low and middle-income SIDS show an impact of climate-related catastrophes averaging to 23% of GDP, which is much higher than non-SIDS LMICs. Reversely, the nominal impact is much smaller: it averages $440 million in SIDS and $3 billion in non-SIDS LMIC. It makes the case for a timely and appropriate global response to such events, even though debt service suspension might not be sufficient: external debt service (all creditors) amount on average to 2,8% of GDP in SIDS, and it mainly skewed towards multilateral lenders. Additional financial instruments, such as debt swaps, contingency loans and insurance-based mechanisms (that the UN has been a proponent for) might be necessary to avoid a spiraling debt-climate nexus in SIDS. Grants and/or financing enhancement shall be part of all these financial mechanisms.

[1] Bangladesh 2007, Benin 2010, Bosnia 2014, Burundi 2014, Djibouti 2018, Georgia 2015, Guatemala 2010, Lao 2019, Madagascar 2008, Malawi 2015, Myanmar 2015, Nigeria 2013, Pakistan 2022, Philippines 2009, Sierra Leone 2017, Somalia 2017, Sri Lanka 2016-2017, Togo 2010, Vietnam 2016-2017, Yemen 2008, Zimbabwe 2019

[2] Based on 2023-2025 debt service data derived from the World Bank’s International Debt Statistics (IDS) databank for a sample of 25 LMICs, including Algeria, Bolivia, Cameroon, Cabo Verde, Côte d’Ivoire, Egypt, Ghana, Honduras, India, Indonesia, Kenya, Kyrgyzstan, Morocco, Moldova, Mongolia, Nigeria, Uzbekistan, Pakistan, Papua New Guinea, Philippines, El Salvador, Sri Lanka, Tajikistan, West Bank and Gaza, Tunisia, Ukraine and Vietnam.