IF-CAP Recap: The Asian Development Bank’s Big Climate Finance Bet

May 11, 2023

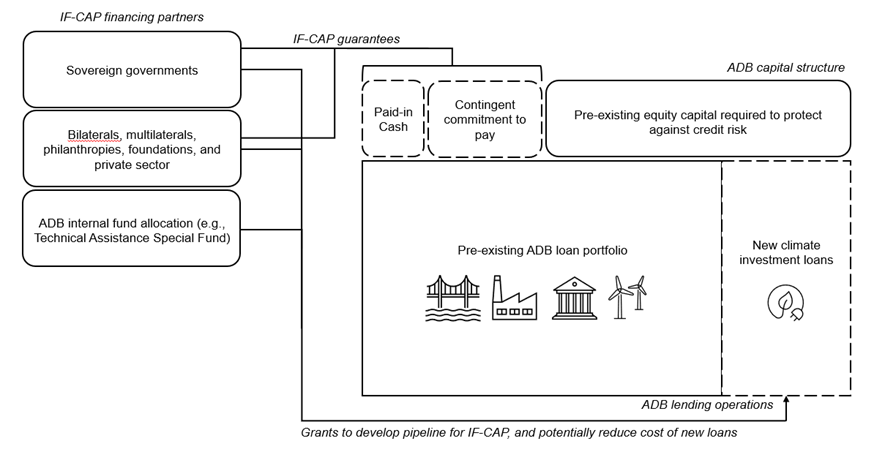

At its annual meetings last week in South Korea, the Asian Development Bank (ADB) launched a new large-scale climate finance mechanism, the Innovative Finance Facility for Climate in Asia and the Pacific (IF-CAP). IF-CAP is a donor-backed guarantee facility, where public, private, and philanthropic financing partners take risk off the ADB’s balance sheet by guaranteeing to backstop repayments for ADB mitigation and adaptation climate projects. By guaranteeing repayments on specific climate investments, IF-CAP will free up significant new space for ADB climate lending. Over an initial 5-year investment period, the ADB hopes to raise $3 billion in guarantees from financing partners, which could enable as much as $15 billion for climate projects across the region.

Guarantees are having their moment in the sun as instruments with proven leveraging ability. There are two types of multilateral development bank (MDB) donor guarantee mechanisms—sector portfolio guarantees and country-based guarantees. Sectoral portfolio guarantees like IF-CAP or the International Finance Facility for Education (IFFEd) aim to grow lending to a specific type of project by creating additional headroom, and sometimes providing loan buy-downs in the form of grants to incentivize project borrowing by making it cheaper. Country-specific guarantees, in contrast, de-risk loan exposure to a particular country to enable additional lending to that country especially if they are hitting against prudential lending thresholds. These have been widely used in the Ukrainian context where World Bank risk exposure limits would have otherwise prevented a major increase in lending to Ukraine. Donors—including the UK and others—have provided over $1.8 billion in guarantees since February 2022, which has enabled the World Bank to extend $3.4 billion in financing to Ukraine on its own balance sheet, far above what Ukraine’s current credit profile would have otherwise allowed.

Figure 1. IF-CAP conceptual overview

Source: Adapted from diagram in IF-CAP concept note.

The IF-CAP model is ambitious—$3 billion of guarantees is expected to mobilize up to $15 billion in additional lending. How does this work? Like all banks, MDBs like ADB use leverage—meaning they lend out more money than they have on hand by borrowing on capital markets in against equity. So, even though its equity totals $54 billion, ADB’s total assets (debts owed to them), add up to $291 billion—an approximately 1:5 ratio. Thus, as ADB frees up risk capital by using a guarantee, it should be able to scale up new climate lending at a similar ratio.

This is an extremely financially attractive mechanism for donors. Because guarantees are a promise to pay in the event of a default within the MDB’s portfolio (which, because MDBs enjoy seniority relative to other creditors, is very unlikely), = financing partners only need to set aside a fraction of the guarantee amount in cash, with the remaining amount provided as a commitment to pay if the guarantee is called. This means that, while the guarantees that underpin IF-CAP are expected to be leveraged 1:5, the actual cash provided by donors is a small fraction of the guarantee provided.

The precise level of leverage provided by IF-CAP still remains to be seen. To date, IF-CAP has only received pledges from sovereign donors. Of IF-CAP’s six founding partners (Denmark, Japan, the Republic of Korea, Sweden, the United Kingdom, and the United States), the US has made the greatest commitment, with a request for a $1 billion guarantee currently pending congressional approval. At the US subsidy rate (which determines how much cash it needs to put aside for a sovereign guarantee), this would require only $84 million in cash. Underwriting a $1 billion guarantee, this $84 million would enable $5 billion in additional ADB lending, resulting in an enormous 59x cash-to-lending leverage rate.

The US contribution, and the subsidy rate formula that underpins it are country-specific, and so other partners’ contributions could take different forms (IF-CAP accepts grants, cash, and other guarantee-like instruments, including risk participations, promissory notes, and/or similar arrangements). Other partner contributions, including that of the US, are still awaiting approval, so the actual volume of IF-CAP remains to be seen.

Of course, the IF-CAP model isn’t completely without risk. While the ADB’s preferred creditor status makes a payment default on one of its loans unlikely (and virtually without precedent at an MDB), a black swan event is not completely impossible. In the event of a payment default by one of its borrowers, financing partners would have to step in to pay the amounts due to the ADB subject to the amount they agreed to guarantee, either on a pari passu (with losses shared equally between ADB and guarantors) or first loss basis (where losses are covered by financing partners exclusively until they reach the maximum guarantee coverage amount). As further mitigation, IF-CAP guarantees cover a synthetic reference portfolio of ADB loans, meaning the risk of a default will be spread across multiple ADB borrowers and no specific loan in the portfolio can be identified. In contrast, the risk of a guarantee being called on a country-specific guarantee is much more proximate. For example, it is not improbable that Ukraine could default on its World Bank loans, in which case donors would have to pay back them back instead.

Ultimately, IF-CAP is a big win for climate and development finance. In a time of growing need and tightening budgets, initiatives like IF-CAP that tap into the comparative advantages of MDBs—high credibility, preferred creditor status, and financial leverage—should be supported and expanded across the system. The ball is now in financing partners’ court to make good on their pledges to enable ADB to fulfil IF-CAP’s potential.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.

Learn more