What the World Bank’s Country Climate and Development Reports Tell Us About the Debt-Climate Nexus in Low-income Countries

April 11, 2023

The pandemic sent governments worldwide into emergency mode, mobilizing resources against immediate disaster. While the entire world has contended with inflation and economic uncertainty since then, low-income countries (LICs) — defined as those eligible for interest-free loans from the IMF’s Poverty Reduction and Growth Trust — have had to do so while continuing to struggle against extreme poverty and operating from a limited revenue base.

LICs are disproportionately impacted by poverty and climate-related disasters; representing only 17% of the global population in 2022, they are home to over 60% of people living on less than $2.15 per day and 40% of those affected by disasters.

Further compromising LICs’ ability to meet these challenges, over half assessed by the IMF and World Bank are at high risk of, or are already in, debt distress. With this list including 23 of the 50 most climate-vulnerable nations in the world, the UN has called for urgent debt relief based on realistic assumptions about countries’ exposure to climate shocks.

In 2022, the World Bank published new diagnostics to help countries better understand their climate risks and prioritize options for achieving low-carbon climate resilience alongside their development goals. The initial set of Country Climate and Development Reports (CCDRs) covers 25 countries, 11 of which are LICs. These reports provide further insight into the challenges facing developing countries as they experience increasing climate impacts.

Interconnections between sovereign debt and climate change can lock governments in a vicious cycle where not only are losses and damages increasing from climactic variability and temperature rise, but the cost of raising money for public investments is, too.

With such constrained government budgets, developing countries cannot make the investments in the low-carbon, climate-resilient development needed to escape this doom loop. Over time, the costs of taking such action also grow further out of reach, as the timeframe for successfully reigning in global temperature rise shrinks.

The joint framework used by the IMF and World Bank to regularly assess debt sustainability in LICs is being revised for 2023, but fully understanding the dynamics between climate and debt requires additional tools, capacity and instruments. The World Bank can play an important role in helping LICs address mounting trade-offs between their short-term needs, such as poverty and disasters, and long-term investments in a more prosperous and stable future.

The World Bank’s CCDRs are a valuable tool in this process. The CCDRs estimate how different IPCC scenarios increase temperature and precipitation variability in the given country and aggregate economic costs from these climactic impacts by 2030, 2040 and 2050. In offering a portrait of the interconnected debt and climate crises, they point to the need for a more fundamental shift in the solutions offered by international financial institutions to support sustainable development in low-income countries.

Here are four takeaways from the CCDRs:

1) Lower-income countries at higher risk of debt distress also face greater economic losses from climate change.

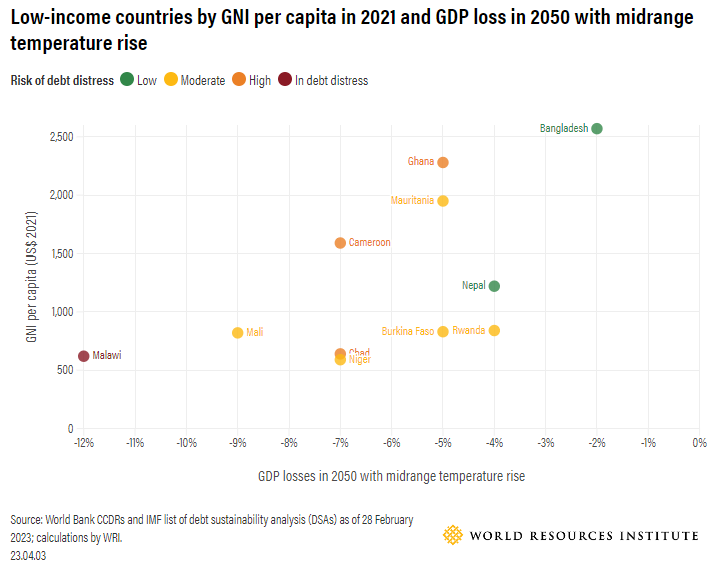

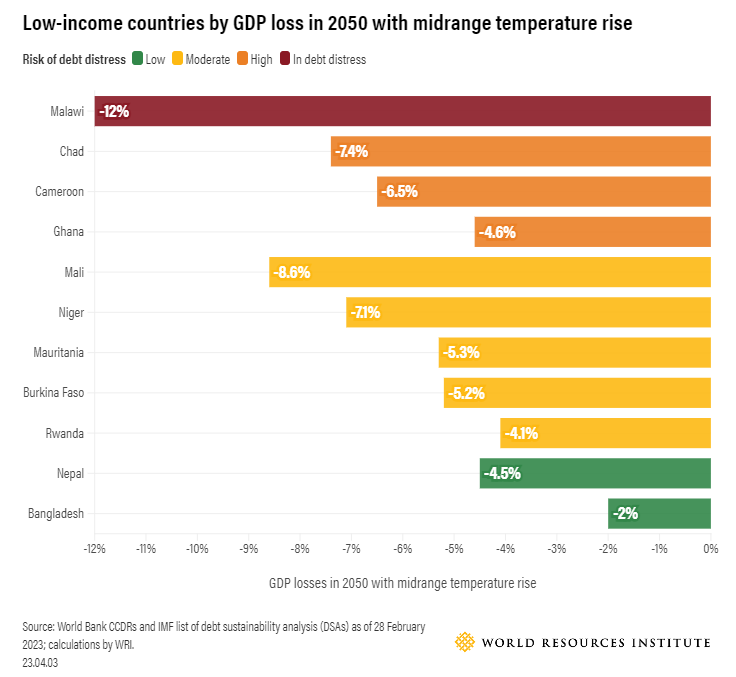

Even with limits in data coverage, CCDRs already show that climate change will impact overall economic stability in LICs. However, countries with lower GNI per capita and higher risk of debt distress face larger losses from climate impacts.

The World Bank calculates potential losses in CCDRs based on deviation from a theoretical baseline where countries can continue business as usual and climate change doesn’t exist. Using mid-range climate scenarios (i.e., in between the optimistic and pessimistic assumptions for global temperature rise), countries expected to lose 7% or more of GDP in 2050 have per capita gross national incomes that range from $590 in Niger to $820 in Mali in 2021. In comparison, countries projected to lose less than 7% of their GDP in 2050 range in GNI per capita from $830 in Burkina Faso to $2,570 in Bangladesh in 2021.

Malawi, which is already in debt distress, is projected to experience the greatest losses at around 12% of GDP in 2050. Bangladesh and Nepal, which both face low risk of debt distress, will experience significant losses too, but the estimates are much lower at 2% and 4% of GDP in 2050, respectively.

Chad and Ghana are amongst only four countries that have requested debt treatment under the G20 Common Framework, which was launched in late 2020 and has drawn strong criticism for its glacial progress. Only Chad has reached an agreement with its official and private creditors so far, a process which took nearly two years to complete and which, after all that time, did not even reduce the country’s overall debt. Instead, a month before a deal was reached in November 2022, the committee of creditors overseeing Chad’s case determined that “no debt relief from official bilateral creditors is currently needed given the surge in oil prices.” Nevertheless, Chad has been recategorized by the IMF as remaining at high risk of debt distress and is forecasted in 2050 to be amongst the hardest hit by climate change at over a 7% drop in GDP compared to a business-as-usual baseline. The IMF has called for greater clarity on steps, timelines and enforcement of comparable terms across creditors to improve the Framework, as well as providing countries with a debt service payment standstill during negotiations to incentivize faster procedures to debt restructuring.

What types of climate-related impacts and challenges are examined in Country Climate and Development Reports?

CCDRs provide a strong basis for understanding dynamics between development and climate change but each report is explicit that it does not provide a perfectly comprehensive picture of all potential damages. Some losses and damages are more commonly examined and integrated than others. For example, all the CCDRs published so far for LICs assess how overall heat stress and changes in rainfall lead to flood damages, negative impacts on human health and losses in agricultural and labor productivity. A few of the CCDRs point to specific physical risks that were likely present but could not be examined in detail due to data or capacity limits, such as extreme heat and flood events beyond more general variability and wider economic damages such as reduced access to work and services.

Climate-related challenges beyond physical damages tend to be examined separately from the core modelling exercise in each report – e.g., only Ghana’s CCDR simulates air pollution damages while others draw upon studies that have already estimated these costs. The G5 Sahel is the only CCDR for LICs that estimates potential impacts of a structural decline in oil prices under a decarbonization scenario, including the risk of stranded assets. However, this may be because Chad (included in the G5 Sahel) is the only LIC amongst the reports that can be classified as hydrocarbon dependent. Further, some of the CCDRs refer to stranded asset and carbon lock-in risks – e.g., Ghana and Bangladesh – without specific estimates.

2) Adaptation investments pay for themselves, yet significant barriers remain to financing resilience in low-income countries.

CCDRs show that investments in climate resilience pay for themselves but are also liable to increase debt burdens. The reports convey a need for broader financing packages which mobilize new sources of domestic revenue – e.g., from taxation of high-carbon sectors. However, the limited public sector capacity to deliver tax reform and improve policy frameworks, as well as their typically low carbon footprints, make the complex balancing act of such solutions a challenge for many LICs.

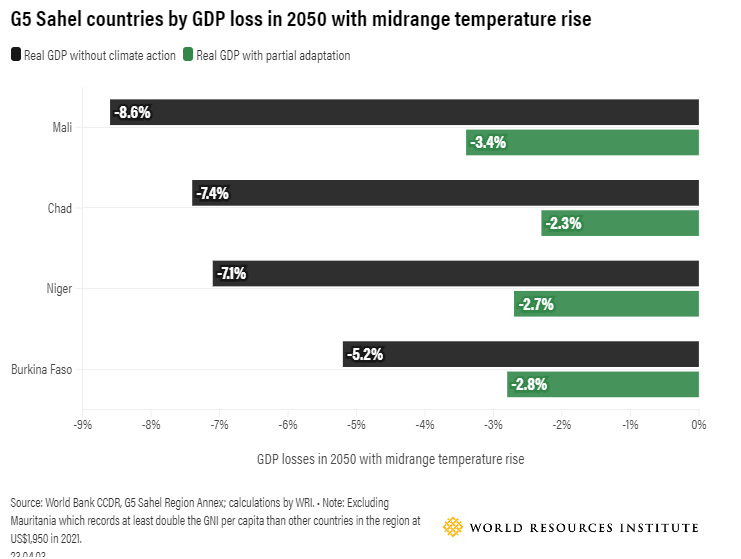

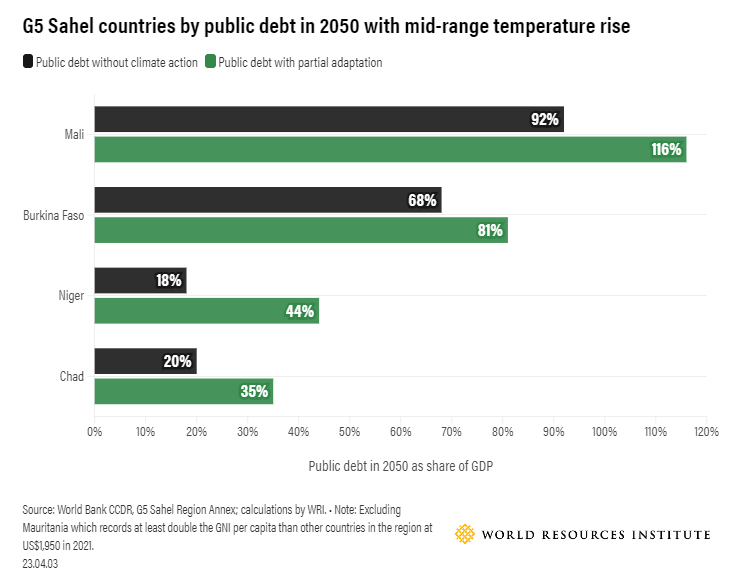

The G5 Sahel CCDR provides macroeconomic and fiscal projections under different climate scenarios for a regional group rather than a single country. This makes the data within a bit more comparable because it uses the same assumptions for projections of GDP growth and examines the same channels through which climate change will affect these economies. Compared to a scenario of mid-range temperature rise without any climate policies, the level of GDP in 2050 ranges from 2.5% higher in Burkina Faso to 5.3% higher in Mali when partial adaptation investments are made in agricultural crops, livestock and infrastructure.

But public debt is considerably higher as well in the case where countries invest in adaptation; it results in additional debt ranging from 15% more of Burkina Faso’s GDP in 2050 to 29% more of Mali’s. Mali’s public debt grows considerably every 10 years, from 47% of GDP in 2020 to 116% in 2050. Burkina Faso follows the same trend to a lesser magnitude, with public debt rising from 48% of GDP in 2020 to 81% in 2050.

The G5 Sahel faces significant fiscal constraints and, as none of the countries can raise significant external financing from private markets, international financial institutions will be critical to supporting adaptation investments that do not overburden governments with debt. From 2019-2021, public debt levels grew by 12-13 percentage points of GDP in Burkina Faso, Mali and Niger, and stabilized at an unsustainable level in Chad. And in 2021, concessional loans – i.e., lending with a grant component from public financial institutions – represented 70-90% of each country’s external debt portfolio. The region’s CCDR shows that adaptation investments are needed to preserve GDP growth in each country. As bank staff only assess currently available options for funding these benefits, the accompanied accumulation of debt should be read as a call for the international community to provide better financing solutions that support climate resilience in LICs.

3) Considering climate change in public financing is critical, but more differentiated solutions are needed for the most vulnerable countries.

The World Bank’s CCDRs recommend that LICs improve the integration of climate considerations in public finance decisions to manage potential trade-offs. However, some LICs already struggle to keep up with the finance needed to address the climate damages that are already occurring, let alone achieve the actual aim of preventing climate impacts in the first place.

CCDRs identify high-priority actions by considering which solutions are feasible and factors such as whether they bring benefits that are immediate versus realized over several decades, or whether actions are urgent because delay will increase climate-related risks and costs. For each of the LICs so far, CCDRs have recommended greener public finance. This means starting to integrate climate considerations to manage potential trade-offs in public finance decisions for some countries and improving on processes that already exist for others.

Selected high priority actions for greening public finance management in CCDRs

| Country | Debt distress | Selected challenges to climate finance | Relevant green PFM recommendation(s) |

|---|---|---|---|

| Bangladesh | Low risk | Adaptation investments prevent climate damages but could reallocate funds from more productive investments | Streamline and increase capacity for public investment management; establish a green public procurement framework |

| Nepal | Low risk | Agriculture is highly vulnerable to climate change and contributes 52% of emissions, but capacity and planning is not well coordinated at the federal level | Enhance public expenditure tracking and implementation for climate-smart agriculture development; improve coordination for private sector participation |

| Rwanda | Moderate risk | NDC commitments will prevent economic losses but are equal to spending 8.8% of GDP each year through 2030 | Strengthen public investment management to generate a balanced outcome between different financing options |

| Ghana | High risk | Climate resilient and low-carbon development, before accounting for benefits from pollution reduction, could generate US $66.8 billion in net gains in 2022-2050 but high debt and fiscal constraints hamper large long-term investments | Broaden the tax base and improve the business environment for private investment in green technologies; a moderate carbon tax could reduce emissions 4% by 2040, raise 1.5% of GDP in annual revenues and have positive or negligible impacts on GDP |

| Cameroon | High risk | Climate investments can lead to almost a million fewer people living in poverty from climate change but requires a more favorable business environment for financing options beyond public debt | Replace fossil fuel subsidies with more targeted forms of assistance to the most vulnerable segments of the population; clarify role of national institutions in climate action and include budget lines to local governments for climate financing |

| Malawi | In distress | Investing in adaptation can significantly reduce annual GDP losses from climate change but are estimated at US $2.9-US $5.2 billion per year up to 2050, far beyond what is affordable at current debt levels | Streamline climate-sensitive public investment management across all infrastructure investments; adopt and implement a public asset management policy to support climate resilient investment planning and management |

Source: World Bank CCDRs and IMF debt sustainability analysis (DSAs) list as of 28 February 2023; compiled by WRI

Note: PFM = public financial management

In CCDRs for countries that have a modicum of fiscal space, mainstreaming climate considerations should be conducive to allowing governments to manage trade-offs and overcome budget or capacity constraints. For example, the report for Bangladesh recommends increasing the government’s capacity for green public investment management to minimize the reallocation of funds from productive investments, where social benefits outweigh the costs, toward measures where that may not be the case. The CCDR demonstrates the need to undertake climate action through a balanced finance package when it outlines that GDP and debt outcomes vary for different climate finance strategies. The report states:

“Adaptation investments can be financed by debt, or by deferring other types of public investment. With larger floods, adaptation investments protecting 20 to 40% of the expected asset damage are projected to be most efficient, even if financed at the cost of other public investment. The GDP benefits of adaptation are slightly higher when debt-financed, although this could worsen debt sustainability prospects. Investments in decarbonization could help raise additional revenues.”

The CCDR concludes that in Bangladesh, a “policy framework that reflects climate risks and mobilizes additional domestic revenue, together with greater international support, will be crucial in financing adaptation investment needs.”

However, the CCDRs recognize that greening public finances will not be sufficient to solve the problems facing countries at high risk of debt distress or worse. For example, Malawi’s CCDR also emphasizes green public investment management. At the same time though, the CCDR recognizes that climate damages — resulting for example from Tropical Storm Ana in January 2022, which is estimated to have cost 1.5%-2.7% of Malawi’s GDP – have placed Malawi in a large deficit which is likely to remain, “as there are fewer resources to build new infrastructure beyond what is rehabilitated.”

4) International financial institutions need strong shareholder support to tackle the climate debt trap in low-income countries.

The CCDRs examined all come to the same general conclusion that, when planned appropriately, there are no significant trade-offs between climate action and development. However, needs are far greater than the resources available to developing countries.

The international financial institutions tasked with supporting development in LICs are not yet able to offer clear solutions to address the interconnected debt and climate crises. More support from their shareholders is needed if they are to meaningfully tackle these compounding global challenges.

For example, delivering urgent debt relief is critical in the aftermath of COVID-19 and may occur in the context of growing calls to overhaul the global financial architecture to better serve 21st-century challenges such as the climate and biodiversity emergencies and worsening inequality.

Strong shareholder support is needed to ensure that the public institutions tasked with facilitating global cooperation for shared prosperity are well equipped to preempt the accumulation of sovereign debt amidst growing climate-related shocks. This includes bolstering the capacity of players like the World Bank and IMF to realistically assess debt sustainability needs against countries’ exposure to climate change. It also requires ramping up the availability of grants to ensure that countries which are disproportionately impacted by, and least responsible for, the climate crisis are not saddled with debt burdens that leaves them behind in the global transition to net-zero by 2050.

For those with especially low levels of GNI per capita and high levels of debt, such as Chad or Malawi, needs are already dire, but the currently available solutions are insufficient for achieving low-carbon climate resilience across the full range of complex situations faced by developing countries in the long-term.

Learn more