You Can’t Have It Both Ways: Why the MDB System Cannot Deliver Both Development and Global Public Goods Well

July 26, 2023

A few days ago, Palermo recorded its hottest temperatures since records began in 1791, reaching a scarcely believable 47 degrees centigrade (117 F); Phoenix, Arizona recently recorded 26 consecutive days with peak temperatures above 40; India is presently in the grip of devastating and deadly floods.

The effects of anthropogenic climate change are upon us, and the time for serious action is past due. In this context it is unsurprising that many observers are turning to the multilateral development banks (MDBs) for this action. These are institutions whose names inspire the potential for grand action: the World Bank, the African Development Bank, the Asian Development Bank, and so on. The names imply supranational action—surely their remit must expand to tackle supranational challenges? Indeed, US Treasury Secretary Janet Yellen has repeatedly argued for such an expansion; Ajay Banga, the new president of the World Bank, has explained his mission thus: “We are at a critical moment in the arc of humanity and the planet. The World Bank Group is being asked to lead the way, to double down on development and climate efforts and to deliver even more impact and results.”

And the MDBs take comfort from influential figures who argue that their core mission—the economic development of the poorest places in the world and the eradication of poverty—is not only compatible with this expanded remit, it is complementary to it. Take this, co-written by Lord Nicholas Stern, once chief economist of both the World Bank and the European Bank for Reconstruction and Development:

“Managing climate change and overcoming poverty are the defining challenges of this century. They are deeply interwoven: if we fail on one, we fail on the other. Poorer people are more vulnerable to extreme events, disruptions and shocks such as health hazards, epidemics, natural disasters, conflicts and economic downturns, and they have fewer resources to cope and recover. Climate change amplifies the scale, frequency and intensity of these events and shocks, driving people into poverty and limiting their ability to escape.”

In a new paper published today, I show how—except under very stringent conditions that almost certainly are not those of the world we live in—it is impossible for the MDBs to deliver both development and climate outcomes without compromising on one, or both. Attempting to do so will mean they waste money and act with poor efficiency. And they will trade off directly between them. Wishing this away, as has been the attitude of almost every major figure associated with decision-making on this topic, will mean that it is all delivered badly. Instead of being fit for the future, we are at risk of an MDB system that is bad at everything it does. To understand why, we need a better understanding of what delivering global public goods really means and how the MDB system operates; together, they show that most existing reform proposals do nothing to make the trade-offs the MDBs face any better.

The nature of global public goods

As anyone who has taught economics to an even mildly curious group of students will know, true public goods are actually quite difficult to find in the wild. According to economic theory, they are non-rival (if one person uses the good, it doesn’t make less of it available for other people to use) and non-excludable (once provided, it’s impossible to stop people from using the good). But finding goods that are directly provided that satisfy these criteria is difficult. Teachers and textbooks often use the example of national defence: once the government protects the country, everyone within the country is protected, even those who have dodged taxes and haven’t paid for the defence system. But how do we provide national defence? There is no box we buy in the shops labelled “safety” which the government buys and opens. Rather, it accumulates weapons, systems, and so on that collectively generate a national defence system. But a missile is not a public good: it is both rival and excludable. However, it’s use in a specific way to prevent or deter foreign invasion does generate the side product of national safety. The public good is created by the use of private goods which have spillover effects.

As for national defence, so for climate: no one directly provides a 1.5 degree world. Instead, it is manifested by investing in specific private goods like green energy generation that have a positive spillover (or more specifically, which lack the negative spillover of carbon dioxide emissions that we get from fossil fuel generation). Note again, the green power station is both rival and excludable: building a wind farm here means it can’t be there; I can limit users of the windfarm to those who pay. But the externality it generates—the avoidance of the emissions associated with a gas-fired power plant that we might otherwise have built—is not rival nor excludable: we all benefit from the reduced emissions and we all benefit from a more liveable world, regardless of where on it we are.

What MDBs actually do

This distinction is critical, because it gets to the heart of why there is an almost inevitable climate-development trade-off if we expect the MDB system to deliver GPGs as well as development. Despite their grand names, the MDBs were not set up for truly supranational action. Instead, they invest in time- and-place-specific projects like power plants or roads. Building them in one place means they can’t be built somewhere else. Building more roads means building fewer power plants, and so on. Some of the private development goods the MDBs finance have globally non-rival and non-excludable externalities, but not all of them do; and we must choose which investments to make. To show why trade-offs are almost certain in this context, consider the following three scenarios.

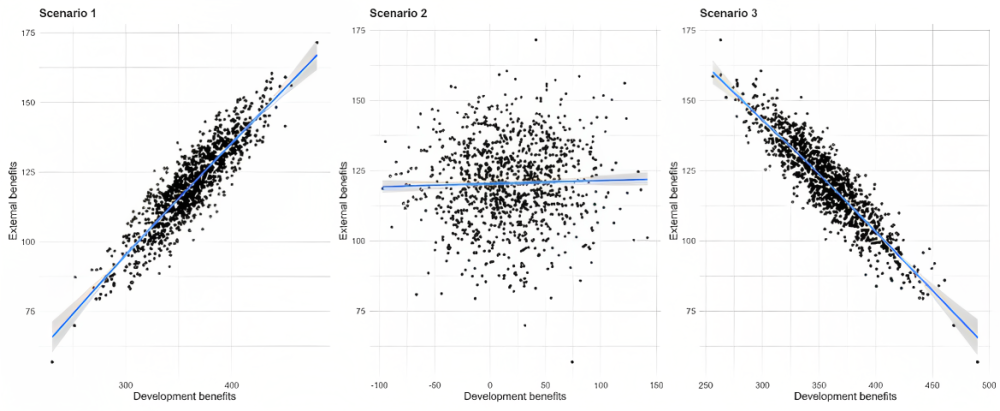

Note: These data are simulated using the statistical package R. Variables (n=1000) are generated and defined in relation to each other to other to create pairs for which the two variables covary positively, negatively and have no relationship to each other at all, and then plotted with a trend line. Code generating these simulations and those in Figure 2 are available here.

In the first, external benefits and local development benefits covary positively; in this case there is almost no trade-off between development and external benefits at the investment level: choosing the best development project almost always means choosing the best (or one of the best) climate projects in this world. In scenarios 2 and 3, however, there are inevitable trade-offs. Investments with big development benefits may or may not have big GPG benefits; and it is not the case that the biggest benefits on one dimension are also the biggest on the other. Indeed, in scenario 3, the trade-off is very stark—you can only have either big development benefits or big climate benefits (I present a less stark trade off in a fourth scenario in the full paper). This might be the case if you believe that all the best development projects are in poor places and all of the best climate activities are in rich places but it does not depend on this: even if the best climate projects are also in poor places (as Seema Jayachandran and Rachel Glennerster recently argued), it just requires that these projects are not the same as the ones with the biggest development benefits even if they are in the same country.

Under scenarios 2, 3 and 4 (in the paper), it becomes almost impossible for an institution charged with doing both development and GPG work to achieve value for money on both. If we pick the best GPG projects, many of them do not have good development outcomes. If we pick the best development projects, many do not have good GPG outcomes. If we limit ourselves only to the set of projects that have both good climate and good development outcomes (which may be a small set, depending on the relationship between them), then we exclude from our choice some very good (often the best) GPG projects and some very good development projects.

There is no way to avoid these trade-offs if one institution is trying to serve both masters. If you believe in a world where the best development projects may have no (or small, or even negative) GPG implications—and all that requires is that we believe in a world where, for example, cash transfers for the ultra-poor, or improving the safety of children in school, or their nutrition are good development interventions—then you have ruled out scenario 1. All other options mean there is a trade-off. A number of further points then follow:

- You can’t have an MDB that does climate and development and maximises value for money on both, as explained above.

- You can’t escape this trade-off by focusing only on win-wins. Firstly, there may not be enough of them, and secondly, optimizing both climate and development will mean sometimes doing projects that are extremely good on one dimension while being very poor or even negative on the other.

- You can’t escape the trade-off with policy lending to countries that have a good climate strategy (for example). If you believe some countries are important for climate but have low development returns, you are right back at the trade-off. And what of countries that have good development strategies but middling climate ones, or vice versa? You are always making trade-offs.

- Arguing that climate outcomes and development outcomes are complements does not resolve the trade-off, even though it is probably true. Better climate outcomes are good for development; and better development increases resilience to climate shocks. But the investments you need to achieve one will often not contribute to the other.

In the paper, I assess a number of MDB reform options and find that all fall short of resolving these problems, some very far short. Others, however, at least make the trade-offs transparent and allow us to pursue value for money in both dimensions: Hafez Ghanem’s proposal for a separate climate MDB does the best on these grounds. Ultimately, only saturation of funding can truly resolve the trade-off. That is not coming from capital increases, and so the pressure to find the mythical trillions our billions were supposed to unlock will only get greater. My fear is that with all eggs in this basket, trade-offs will continue to be wished away, and in doing so our final outcomes will fail on all counts.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.

Learn more